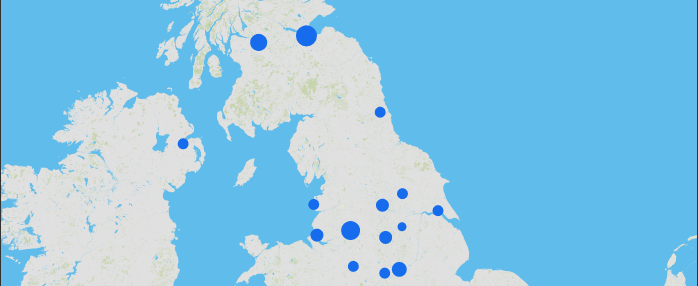

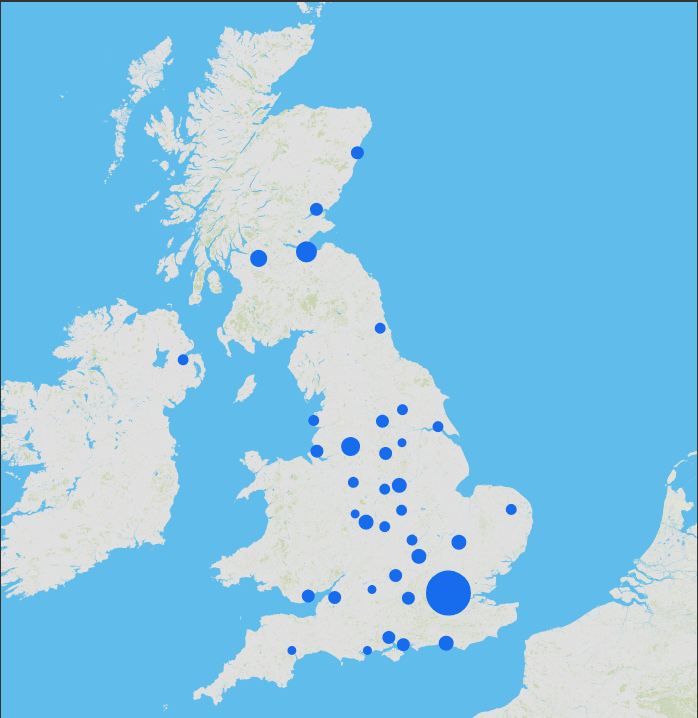

The ODI and the Digital Catapult have today published the UK Tech Innovation Index, showing the UK’s most active innovation communities by industry sector, in an online interactive map.

What problem will this solve?

The aim of the research is to help gain a clearer picture of the UK innovation landscape, and inform business and public sector decision-making around investment and growth.

The index combines data on tech events, conferences and meetups from a range of sources with academic publications, local skills measures, business startup rates, and research and development spending.

Together, these shed new light on where British innovation is flourishing. The rankings show how active the innovation community is in 36 of the largest UK cities, across seven key industrial sectors:

- Data

- Manufacturing

- Artificial intelligence

- Health

- Internet of things

- Machine learning

- Virtual reality

The rankings show that:

- Tech innovation is unsurprisingly strong in London. However innovation is not limited to the southeast: there are highly active hubs across the country, including Edinburgh, Reading, Cardiff and Liverpool.

- Innovation is aligned with local industries in many places, particularly smaller cities. Aberdeen, with its strong offshore engineering industries, and Coventry and Birmingham with their car industries, are today very strong in manufacturing innovation.

- Larger cities have strong innovation ecosystems across all measured sectors, such as London, Manchester, and Glasgow.

Tom Forth, Head of Data at ODI Leeds, who led the project, explains how it is different from other innovation research:

"Our approach to measuring innovation pioneers new ways of picking out the early signs that industrial clusters are emerging. Our results are largely as expected, with large cities such as London, Manchester, and Glasgow performing strongly in all areas and well-known overachievers such as Edinburgh, Cambridge, and Brighton punching well above their weight."

"Interestingly, our techniques seem to spot early signs of more focused excellence. In Reading and Liverpool, we see real strength in Internet of Things. Leeds does very well in Health. And in Aberdeen and Coventry, Manufacturing is notably strong. There are early signs of other new clusters emerging in other new fields, right across the country. The data behind these rankings is improving all the time, as more tech events are held, and more scientific papers are published. We hope that by sharing our research at this early stage we can learn from others and improve our techniques even more quickly."

Jeni Tennison, CEO at the Open Data Institute, says:

"This new research reveals that innovation around data isn’t a London-based phenomenon, with the current methodology highlighting active communities in Edinburgh, Manchester, Brighton and Southampton."

"Using real-time data to identify clusters should help inform innovation policy, where it’s especially important to respond to how things are, rather than how they were, as well as the behaviour of businesses and jobseekers. Developing measures like this in the open also helps to increase our understanding about what drives innovation and which activities create real impact. I’m looking forward to seeing Tom’s work being discussed, adapted and built on."

Dr Jeremy Silver, CEO at the Digital Catapult, says:

"This research confirms and subverts wide-held views on the UK tech industry. While London continues to be a heavyweight player on the global tech stage – innovation is by no means confined to the capital. We’re seeing high potential clusters of innovation across the UK, linked to opportunities identified within the tech sector or aligned to universities or dominant regional industries. Our own Digital Catapult regional centres reflect this too."

About the methodology

The rankings incorporate data from multiple tech-event calendar sites: Meetup, Eventbrite and Open Tech Calendar, and from a new system for classifying scientific publications. The algorithm built to create the rankings combines this data with more widely-used measures, such as: the number of startups in a city; nearby research and development spending; and the percentage of people with degree-level or equivalent qualifications.

Find out more

- How we used tech events data from three sources

- How we used a preview of Microsoft's Academic Knowledge API to understand patterns in academic publications

- Rankings and scores for each city (available under an open license on GitHub)

- How each city's score is calculated (.xlsx)

Anna Scott is Head of Content at the ODI. Follow Anna on Twitter.

If you have ideas or experience in open data that you'd like to share, pitch us a blog or tweet us at @ODIHQ.